Throughout history, data has played a pivotal role in shaping the insurance industry. How can insurers anticipate new scenarios? How do they establish profitable, and logical pricing? How can they effectively evaluate risks and identify potential fraud? Undoubtedly, the insurance sector heavily relies on data, serving as the engine that propels operations with efficiency. In today's complex and dynamic landscape, where companies vie for prominence in an open and diverse market, obtaining quality data and refining internal processes for research and innovation are paramount in achieving success.

In tandem with the scientific and technological advancements of our era, privacy policies are tightening their grip, presenting a challenge in navigating market complexities while adhering to these regulations. Indeed, safeguarding privacy poses an additional hurdle for the insurance industry.

Artificial Intelligence is bringing new tools into the hands of insurers. And within this landscape, synthetic data emerges as a vital instrument, offering the potential to harness maximum benefits.

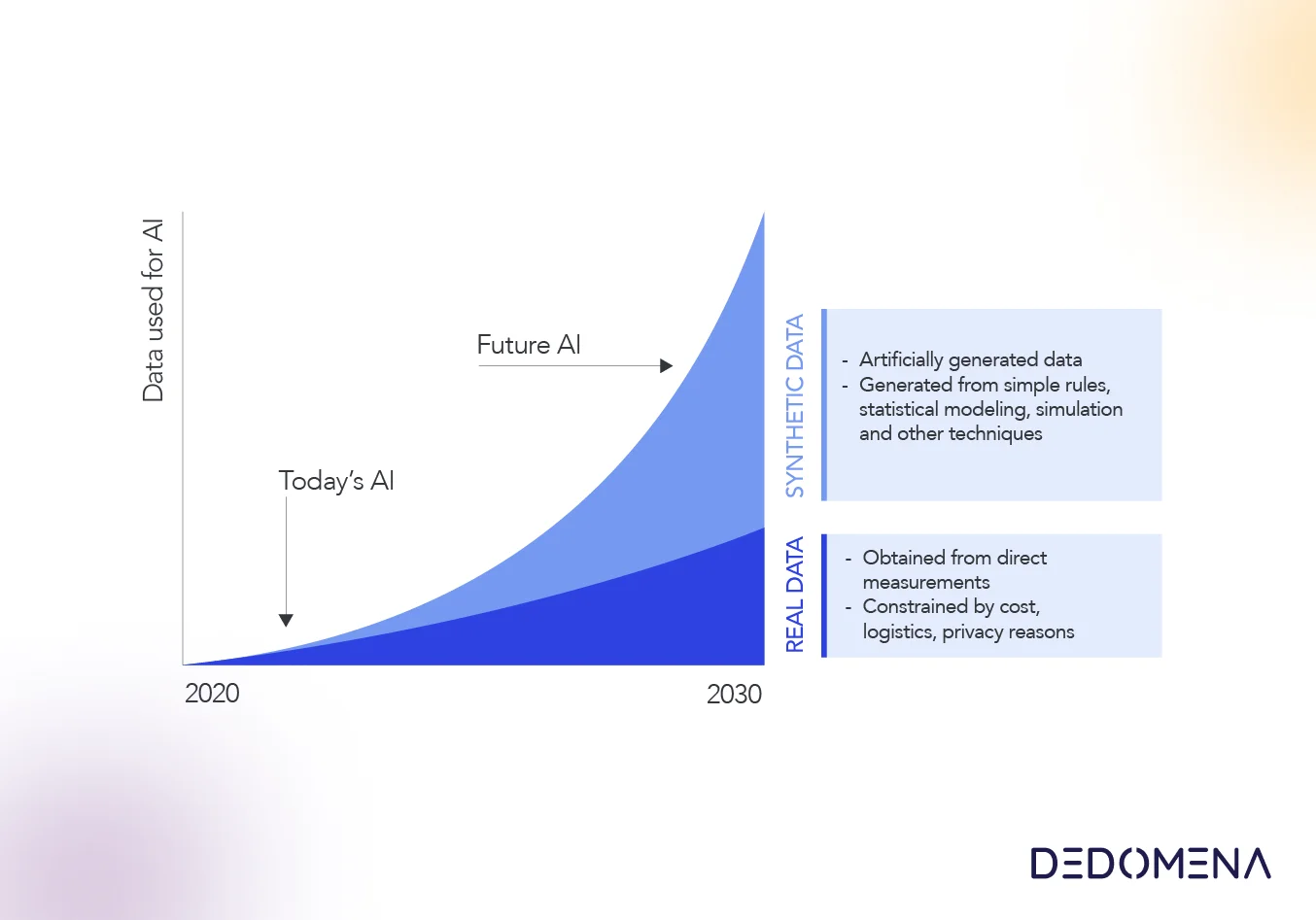

Data for Machine Learning models

Creating optimized synthetic training datasets is a critical step in maximizing the accuracy and effectiveness of downstream machine learning tasks. These datasets serve as the foundational building blocks upon which machine learning models are trained, and their quality and relevance directly impact the performance of these models.

By leveraging synthetic training datasets, data science teams can tailor the data to the specific requirements of the machine learning task at hand, ensuring that the models are exposed to a diverse range of scenarios and patterns. This diversity helps to mitigate bias and overfitting ensuring that the models generalize well to unseen data, ultimately leading to more robust and reliable predictions.

Moreover, synthetic datasets offer the advantage of scalability and flexibility, allowing data scientists to generate large volumes of data quickly and efficiently. This is particularly advantageous in situations where access to real-world data may be limited or constrained.

In addition to their role in initial model training, synthetic datasets also play a crucial role in model maintenance and optimization over time. As AI models are deployed in real-world environments, they may encounter changes in the underlying data distribution or environment, leading to performance degradation. By periodically retraining these models using updated synthetic datasets, data science teams can ensure that the models remain accurate and stable over time.

Data for predictive models

Synthetic data serves as a valuable resource in the creation of training and testing datasets for machine learning models within the insurance industry. These models are tasked with predicting various elements such as insurance claims, risks, and fraudulent activities.

By leveraging synthetic data, insurance companies can enhance their decision-making processes and elevate the accuracy of their predictions. With access to diverse and comprehensive datasets, these models can better capture the nuances and complexities inherent in insurance-related phenomena, ultimately leading to more informed and effective decisions.

Testing and model development

Prior to the deployment of a new machine learning model in a production environment, rigorous testing and validation are essential steps. Synthetic data facilitates this process by enabling the creation of a wide array of test scenarios, each designed to evaluate the model's performance across different conditions and circumstances.

Through comprehensive testing and validation, insurers can ensure that their models not only function correctly but also exhibit robustness and reliability in real-world scenarios. This iterative approach to model development, fueled by synthetic data, fosters continuous improvement and refinement, ultimately resulting in more robust and effective predictive models.

Data privacy and security

By utilizing carefully crafted synthetic datasets, machine learning processes can uphold high standards of security and reliability in accordance with privacy regulations. These synthetic datasets, which replicate the statistical characteristics of real datasets but do not contain personally identifiable information, enable data science teams to develop and test models effectively without compromising individuals' privacy.

This approach not only ensures compliance with privacy regulations but also ensures the integrity and reliability of machine learning models, which is crucial in environments where user data protection is paramount. Furthermore, by using synthetic data for model training and evaluation, organizations can maintain the confidentiality of sensitive information while continuing to innovate and enhance their artificial intelligence systems.

Key considerations

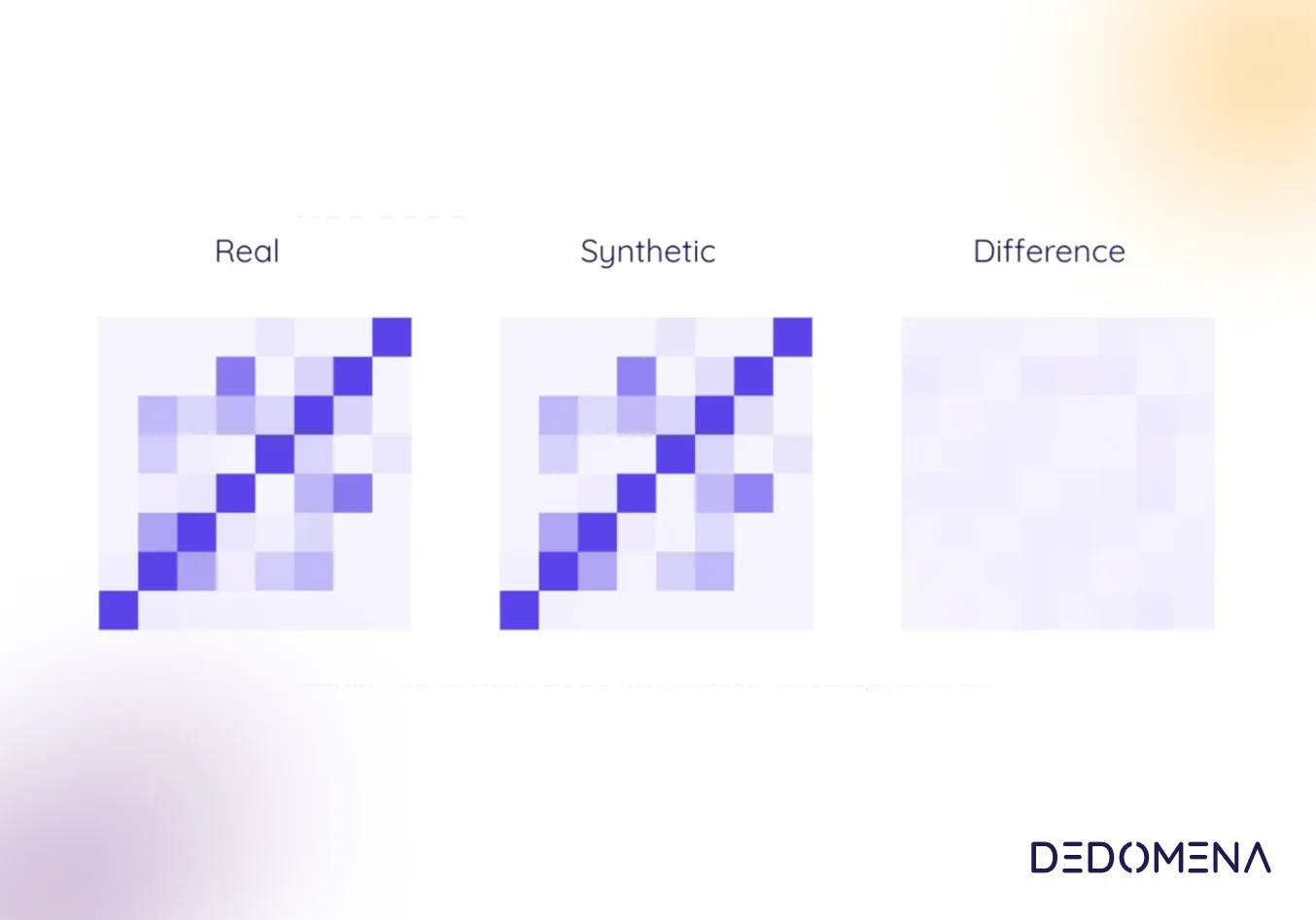

Quality of synthetic data:

It is crucial that the generated synthetic data closely resembles real data in terms of distributions, correlations, and relevant features. This ensures that machine learning models trained with synthetic data are effective in predicting real-world events.

Ethics and compliance:

Insurance companies must ensure compliance with all relevant legal regulations, such as the General Data Protection Regulation (GDPR) in Europe or the Health Insurance Portability and Accountability Act (HIPAA) in the United States. The use of synthetic data offers insurance companies an effective solution to address privacy concerns. In this way, they can maintain the integrity of sensitive data while adhering to privacy regulations, enabling them to operate ethically and legally soundly.

Validation and evaluation:

Before deploying machine learning models in production, it's essential to validate and evaluate their performance using both synthetic and real data. This ensures that the models are accurate and reliable in real-world situations.

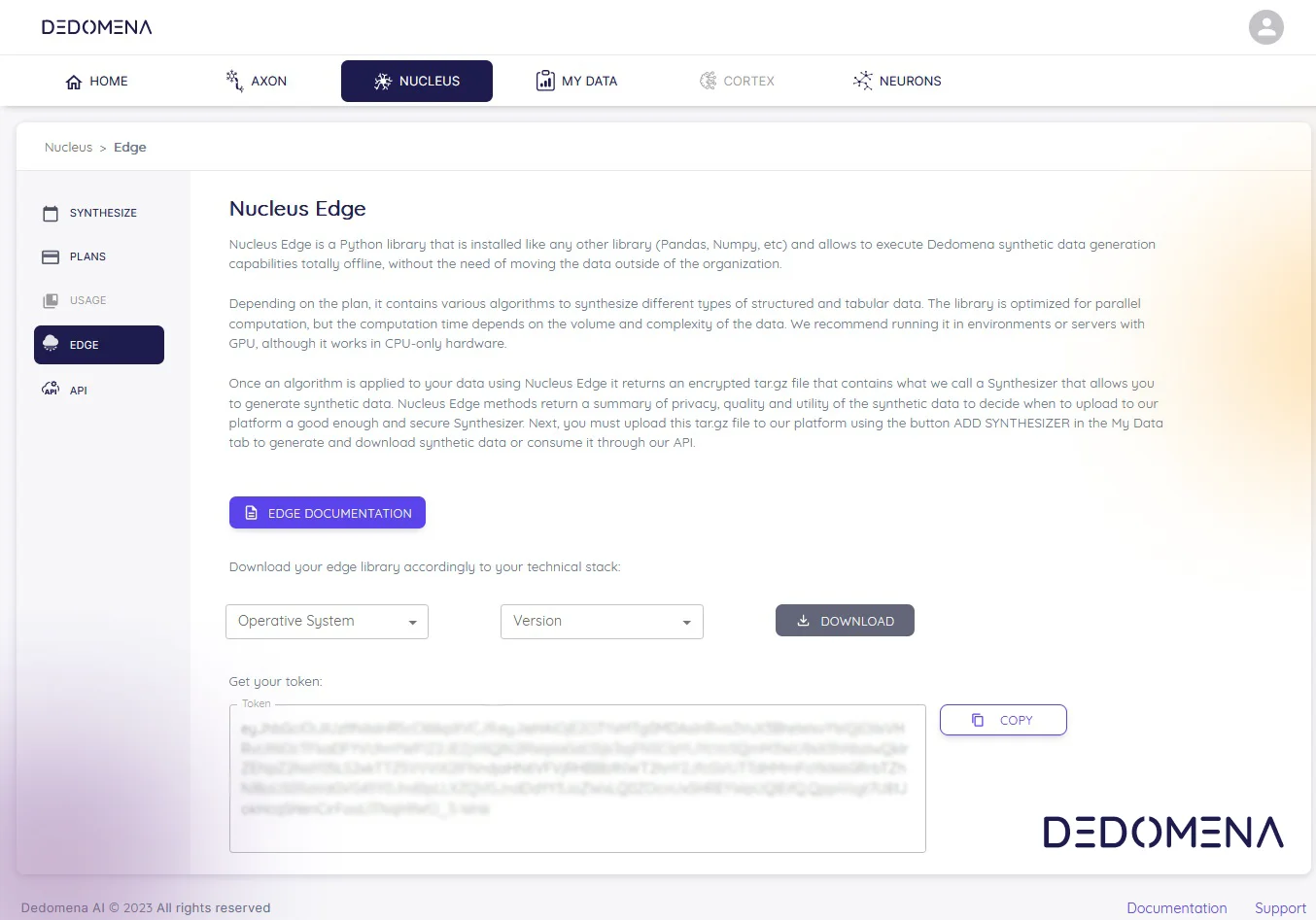

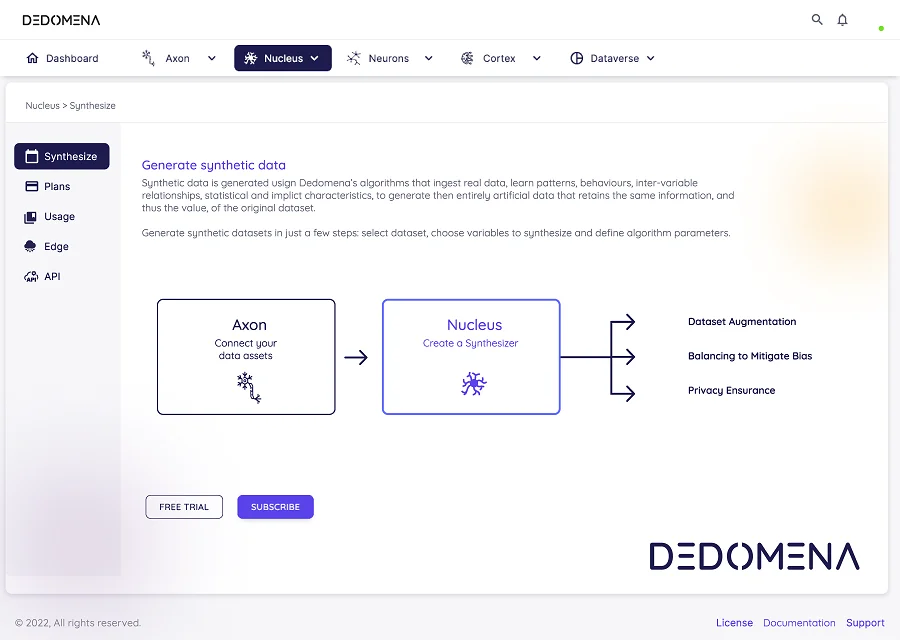

DEDOMENA's platform revolutionizes the landscape for insurance companies, offering several benefits to enhance their machine learning capabilities. By seamlessly integrating synthetic data generation with powerful data enrichment functionalities, the platform enables insurers to significantly accelerate their time-to-data and time-to-insight. This swift access to high-quality data fuels the entire AI development lifecycle, resulting in improved performance and expedited deployment of machine learning models.

DEDOMENA empowers insurance companies to unlock the full potential of machine learning, driving innovation, and efficiency while delivering superior outcomes across various applications.