Our vehicles collect a tremendous amount of data that can be used to develop and run innovative applications. Mobility-generated data allows us to run connected vehicles services, improve road safety, enable autonomous driving, provide an intelligent personal assistant, and the list goes on. With ready access to this valuable data in formats that are secure, usable and actionable, insurance companies as well as companies in other industries can use it to get more customers, increase profitability with faster, better underwriting and claims processing, and create better customer experiences.

What is mobility data?

Mobility data is the geographic location of a device, passively produced through normal activity, that refers to the trajectory of people and objects. Location-based data is growing more and more common in several application domains, thanks to the many modern location-based services offered through our smartphones and next-generation vehicles.

Companies, researchers, and other entities are beginning to collect, store, and process mobility data; but they are also facing the challenge of consent and privacy management. Whilst users are aware of the potential value it has, companies who are willing to monetize data by extracting insights from it or sharing it with third parties must comply with current data privacy laws.

Since mobility data refers to the trajectories of people and objects, having access to this information provides deeper insights into how people live, travel, and move around. In the insurance industry, for instance, the movement patterns of people are of a particular interest, since insurers can make use of it to better understand customer preferences, and therefore provide better customer experiences and pricing.

The ability for processing real-time mobility data and being able to translate it into higher-level information, is fundamental to make value out of the connected data. Artificial intelligence now allows insurers to learn from this data to develop new models, features and services that are even more tailored for users.

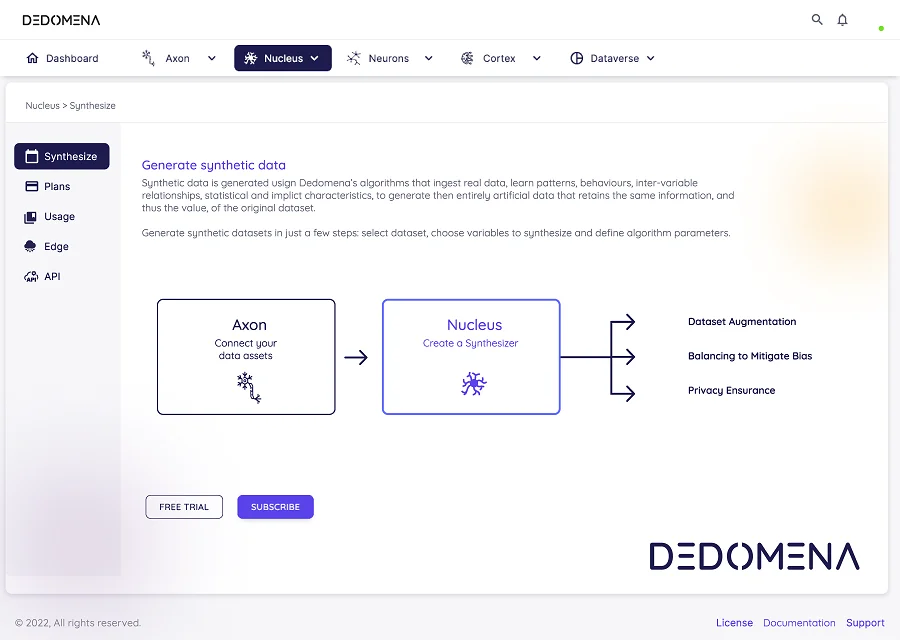

It also is important to emphasize the importance of sharing mobility data. Synthetic data can support several approaches in which the exchange of mobility data can promote innovation, lead to better decision making and enable the development of better products.

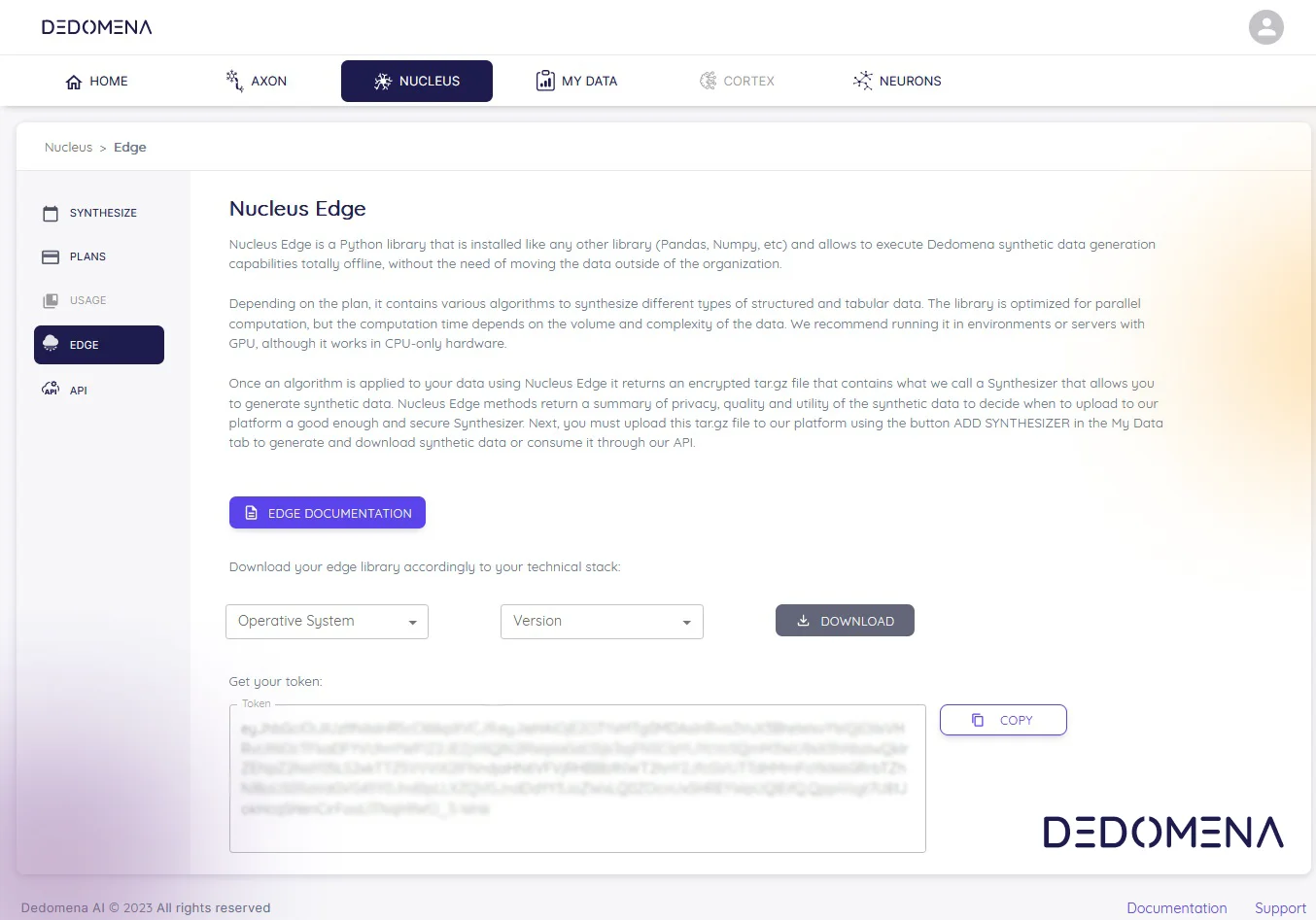

Of course, customer needs should always be at the centre of innovation. Companies that want to set the industry benchmark regarding the security and privacy of their customers´data will embrace the potential of AI-generated mobility data. Synthetic data will allow companies and customers to have full control over their data, unlocking the real value from it without compromising privacy and security.

Redefining the insurance industry with synthetic mobility data.

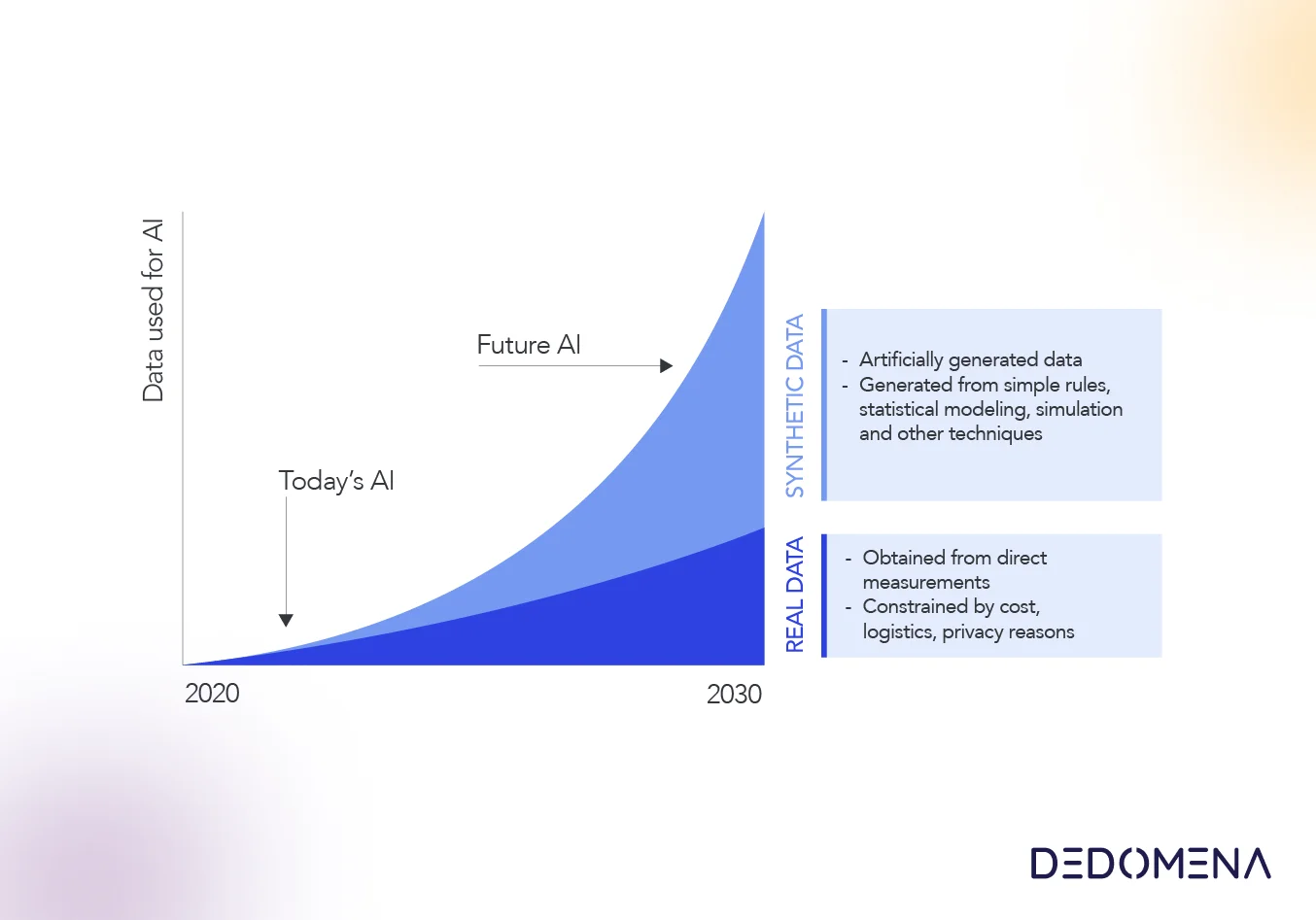

As mobility data is rare and hard to collect, insurance companies have begun exploring solutions for synthetically generating it. Synthetic datasets are quickly replacing older approaches to data anonymization including data masking, “pseudonymization,” randomization, permutation and generalization. This approach is much more secure, and datasets can be created in a fraction of the time, saving money and accelerating AI model development.

Insurers should be at least experimenting with synthetic data, with an eye toward making it a core element of AI modeling in the very near future. Insurance is a business built around risk and having a wealth of information, including synthetically generated, is critical to mitigating such risk. With information such as mobility data, advanced customer demographics and external datasets, insurers will be able to improve their understanding of their customer´s needs. Besides being able to advertise effectively to prospects of all ages and routines, insurers can also leverage on such data to increase customer engagement. In an industry with increasingly price-sensitive consumers and stiff-as-nails competitions, effective customer engagement and usage-based pricing may be the deciding factor that separates winners from the losers.

Here are some examples of how insurers can use mobility data to increase conversions, reduce costs and create new innovative products and services:

-

1. Improve targeted advertising

Targeted advertising involves connecting with audiences who are able to relate to the benefits that the product offers, increasing conversion rates dramatically. However, for targeted advertising to be effective, a strong understanding of demographics and customer behaviour is necessary. Insurance companies can make use of synthetic mobility data to execute a high-performing real-time campaign based on the location and intent of car buyers to purchase auto insurance. Also, by using mobility data, insurance companies could customize advertising messages to address the needs of new or used car buyers in the area so as to increase relevance and conversions, improving as a result the return on investment of their campaigns.

-

2. Maximize revenue by upselling

By upselling, insurers can offer customers additional products and services such as extra coverage on top of basic policies or upgrading them to more comprehensive ones. In order to upsell effectively, insurance companies have to understand their customers´s intent. In order to know what additional products and services their customers would want in the near future and upsell effectively, insurers must look at synthetic mobility data. For instance, based on mobility information, an insurance company can offer additional services such as sports insurance for customers who are travelling to the mountain. This would allow them to maximize their revenue and provide customers with a delightful experience that will enforce their loyalty with the company.

-

3. Create new products and services

Building the right products and services for customers is essential for any company, not only for insurers. This will not only result in an increase in trust and loyalty, but also leads to customers recommending your product to their family and friends. Understanding who your customers are, how they behave and what they want will help insurance companies customize their products and services to meet their needs. For instance, insurers can create usage-based insurance products such as pay-as-you-drive (PAYD) and pay-how-you-drive (PWYD). Tap into automated mileage verification , time-of-day traffic and driver behaviour tracking. Synthetic data eliminates the biggest barrier to usage-based insurance, the protection of personal data privacy and the prohibitive costs of deploying and managing telematic devices.

-

4. Fraud detection

Insurance companies can also use synthetic mobility data to assess risk by creating realistic simulations of various driving scenarios and then applying the results to their risk management strategies. This information can be used to better predict the likelihood of accidents and the potential consequences of these incidents, allowing insurers to make more informed decisions about risk assessment and pricing. For example, synthetic mobility data can be used to model different types of road conditions, such as heavy traffic, inclement weather, or road hazards, to understand how these conditions might impact driver´s behaviour and increase the risk of an accident. This data can also be used to simulate behaviours of different types of drivers, such as new drivers, elderly drivers, or drivers under the influence of drugs and alcohol, to see how these factors might impact accident rates.

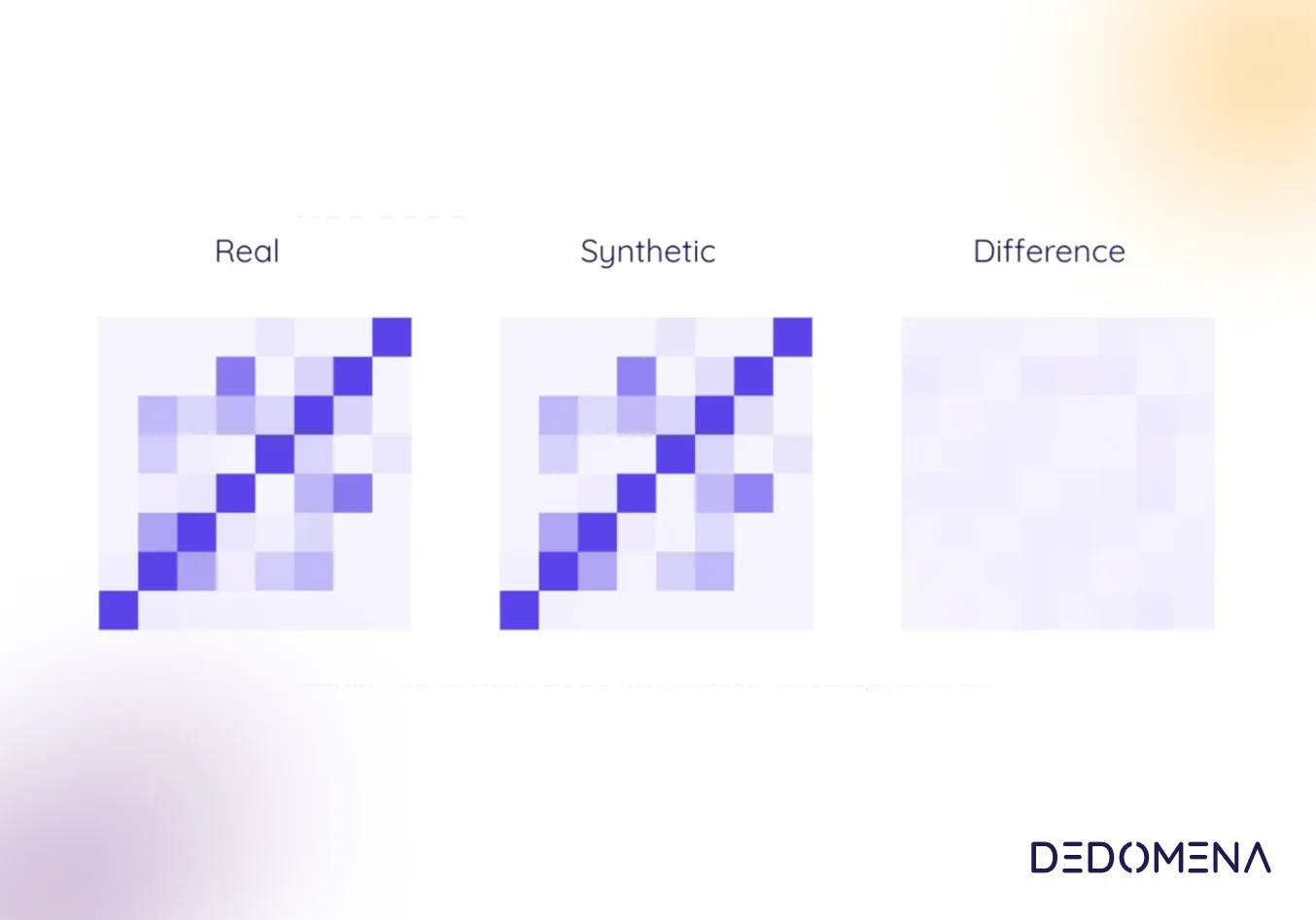

Synthetic data is emerging as a possible solution to all of these challenges. Synthetic data sets contain the same amount of details as original customer data, but without the original personal details. Synthetic datasets without any personal information can also be tweaked to improve balance and representation, and help insurers comply with privacy regulations like GDPR and CCPA.

Overall, synthetic mobility data can be a valuable asset for insurance companies in their efforts to create new innovative products and services, increase loyalty and engagement with their customers, assess risk and reduce fraud, and make more informed decisions about marketing strategies and policy pricing, resulting in a much more durable and profitable business.