Companies have just started to acknowledge the importance and potential of Artificial Intelligence, and thus the application of synthetic data in their data pipelines to ensure the privacy of sensitive data to build safe and accurate machine learning models.

One of the sectors where “data anonymity” is crucial is the financial sector, in which digital transformation is becoming more and more important for the future of the industry (1). The capacity of mixing personal data and banking information respecting GDPR poses a huge challenge for extracting data with real value. Also, as we discussed in our previous blog, Why Traditional Data Anonymization Methods no Longer to Work, conventional anonymization techniques do not ensure either data privacy nor utility.

Despite these challenges, data-driven financial companies have one potential “joker” that makes the difference between obtaining real knowledge and getting in trouble with the data processing: synthetic data.

Data and AI in the banking sector

In the financial services sector specifically, the use of data brings enormous benefits, allowing financial institutions and Fintech companies to offer greater value and personalized services to clients and address business challenges such as stronger fraud detection or cost reduction. Financial data is created with every transaction and action taken by financial institutions as they engage with customers.

The presence of new techniques for extracting value from data such as machine learning or deep learning is increasing progressively across financial services, especially in retail banking or Fintech solutions. Technological innovations have improved the ability of businesses to capture and use customer data. Advanced computing increases the ability to store, manage and transfer data, while advanced analytics permits greater insight into customer behaviors and preferences.

On the other side, these trends also come with certain challenges, limitations and obligations regarding the access and treatment of personal customer data. Customers are not always willing to share certain personal information due to privacy concerns. In fact, 80% of consumers say they are even more protective of their financial data than other personal information. Also, it is common to store “dirty” or incomplete data that is useless for the development of new products or models. In most cases, data sets are not representative and come with biases, making it difficult to obtain reliable machine learning products.

With such large amounts of data and systems using it, now is more important than ever to protect information from internal and external threats. Fines for violating data protection regulations broke a record in 2021, exceeding one billion dollars worldwide, representing an increase of more than 500% compared to 2020.

Benefits of synthetic data in financial services

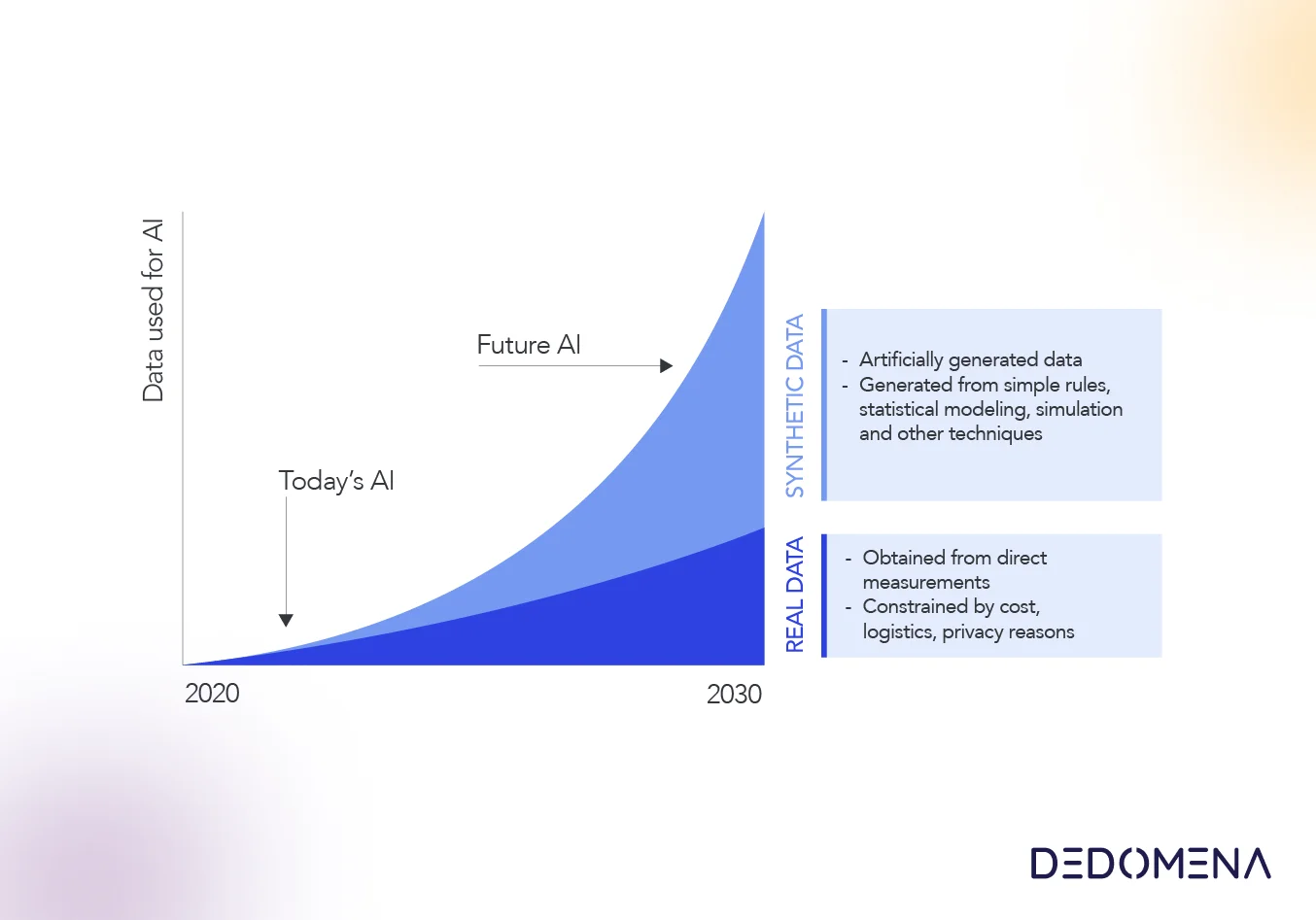

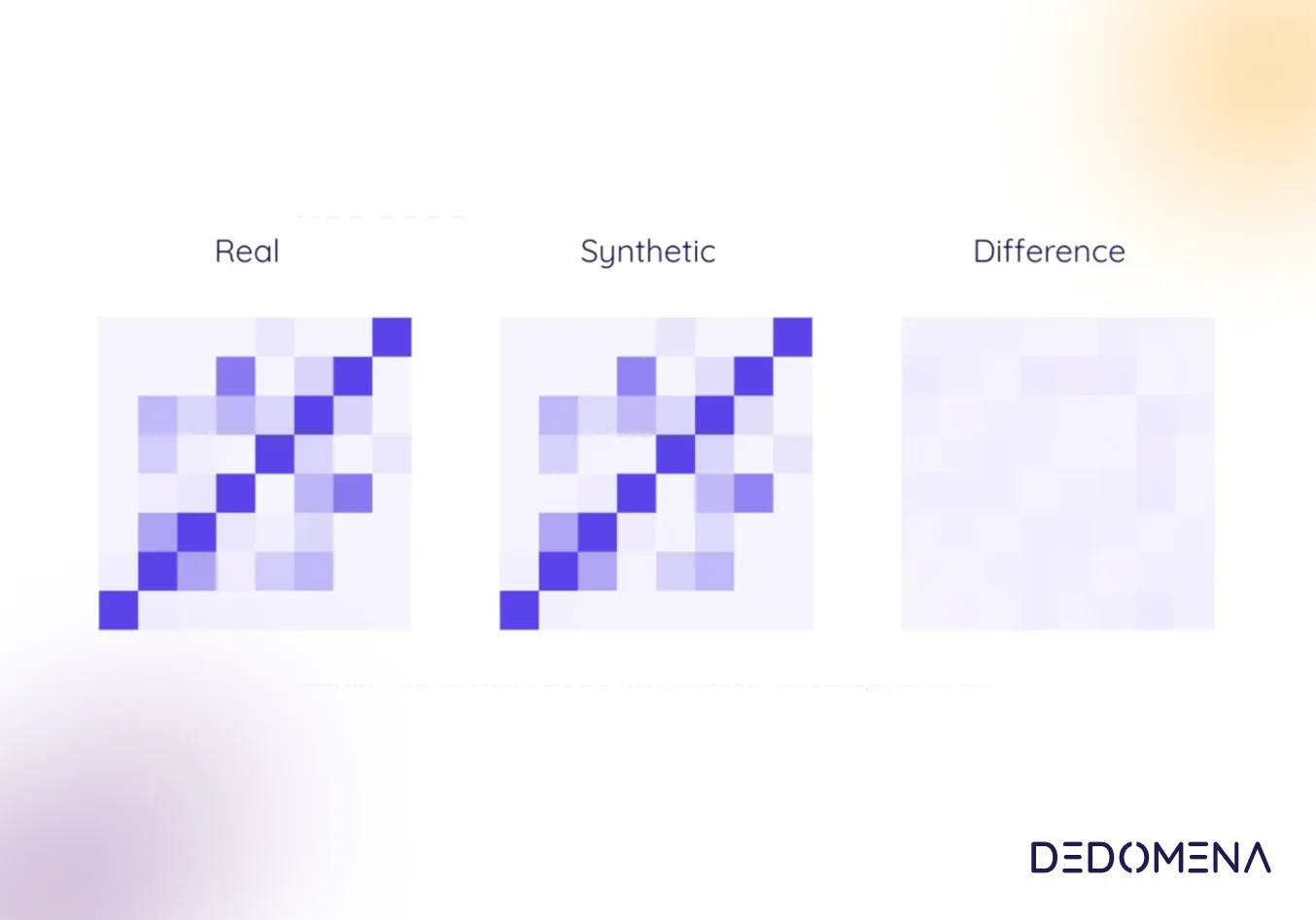

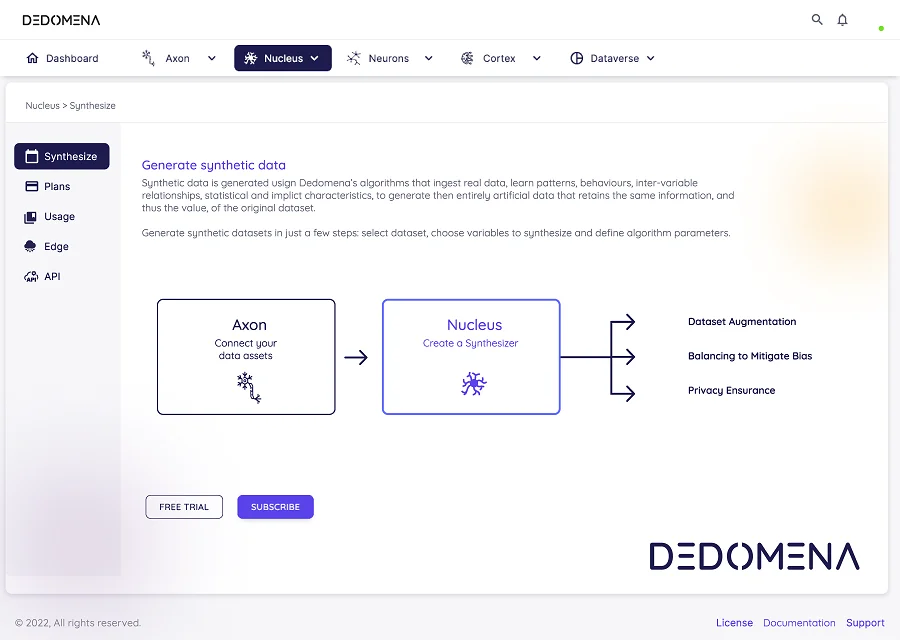

Synthetic data is data artificially generated from the original data but it maintains the same statistical, informational and predictive characteristics. While the real data is collected in each of the physical or digital interactions with people and through internal processes, the synthetic data is generated with an algorithm. This algorithm or synthetic model is capable of generating completely new and artificial data sets. In the creation of synthetic data, a real anonymization process is implicit, that is, the synthetic data is a 100% anonymous data, since its re-identification is impossible, unlike other techniques.

Financial entities will have to go beyond regulatory requirements and the application of best practices in terms of data protection if they really want to make the most out of their data. Synthetic data plays a fundamental role in the development and training of Artificial Intelligence models, and its use will increase as the financial industry moves from “Big Data” to “Smart Data”.

Synthetic data for model creation and optimization is emerging as one of the top AI use cases for financial institutions, representing more than 11% of the total investment in AI, according to NVIDIA State of AI in Financial Services report. This demonstrates the rapid adoption of AI across financial services, which is requiring banks to invest in enterprise AI that ensures the privacy of customers and promotes data innovation in a more cost-effective and secure way.

Along with model accuracy and data privacy, synthetic data comes a host of other benefits such as:

Data solutions with less bias

Usually, the distribution of a dataset carries a bias that implies a negative impact on the efficiency of the model and its future application. In these situations, synthetic data can complement the original dataset in order to balance representativeness with quality data when training a model. This can help Artificial Intelligence reduce bias, being always at the service of the customer.

Data democratization

Providing technical and business teams with quick access to actionable datasets is crucial to fostering a healthy data culture. The use of synthetic data for the development of software and solutions based on statistical models allows for more efficient collaboration between different teams. In addition, synthetic data simplifies the internal data governance strategy and reduces friction between departments, thus streamlining processes.

Better customer-centric products and services

Synthetic data can be used to develop new features, services and products, and later test how certain types of users will react to them. For example, to test a user interaction system through notifications (receiving a notification when your salary is credited in your account), simply create a set of users with a large number of past and future transactions, and thus simulate a user in real time that meets that specific behavior.

Accelerating innovation around data

The use of Artificial Intelligence has to be one of the priorities of financial institutions. If these institutions do not prioritize these methods, they will be under risk of being replaced by other competitors that really are using it. Innovation around data will be much faster if access to data is agile and dynamic, and as effective as the quality of the data.

Guarantee the privacy of customers

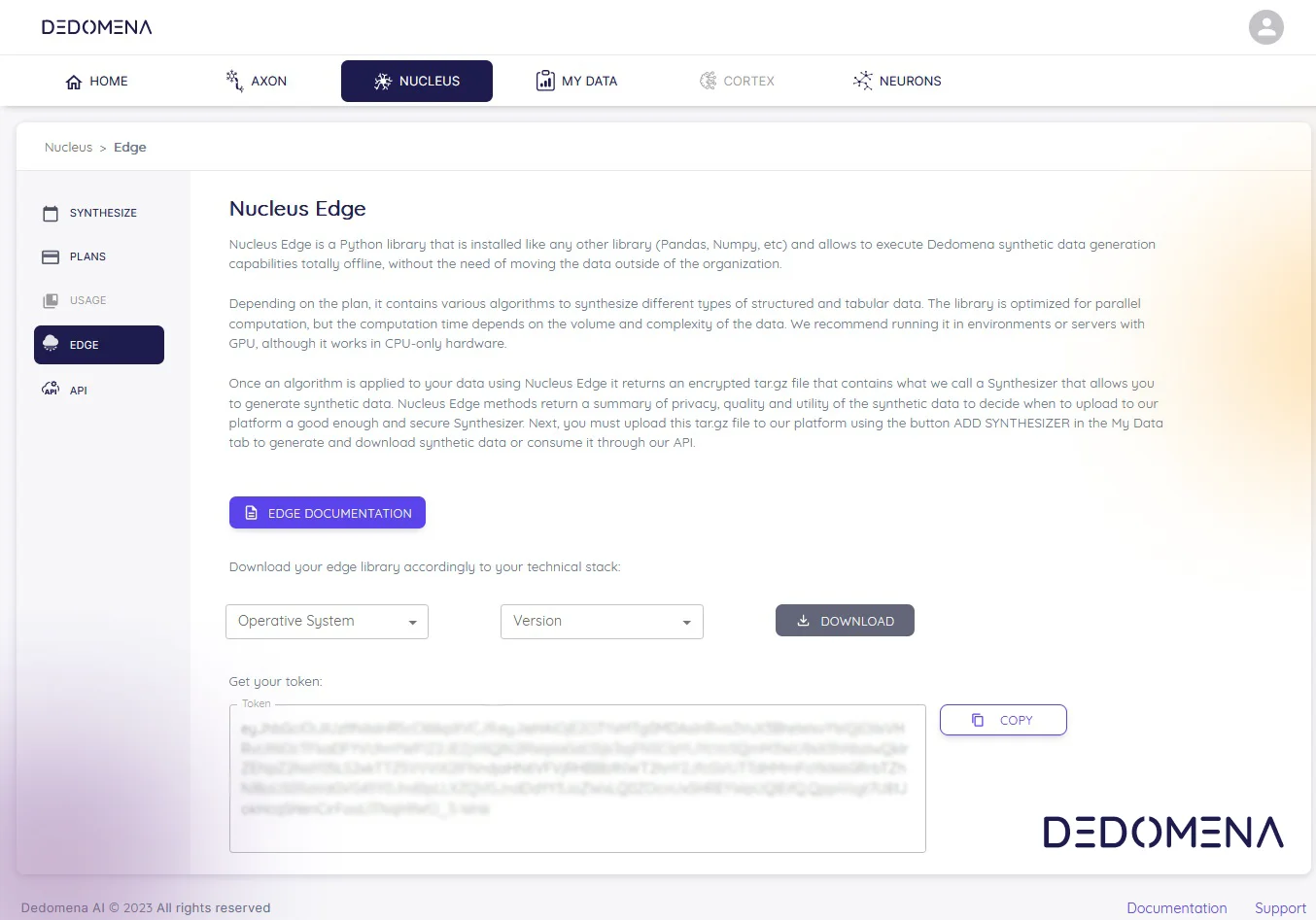

Synthetic data allows financial institutions to create applications and software solutions without exposing personally identifiable information (PII) and/or health information (PHII) of their clients. At the same time, the risk for partners that collaborate with financial institutions in the development of technology is reduced, promoting innovation and putting disruptive Artificial Intelligence initiatives into production, optimizing time-to-market.

Risk reduction

Around 60 % of privacy-related problems are caused by the organization's own employees. This problem increases when these organizations have access to more data. Providing alternatives based on synthetic data to the different teams within the organization, even in the Cloud, is a primary strategy to minimize the exposure of personal data, and thereby avoid sanctions and data leaks.

Conclusion

The use of synthetic data in financial services is becoming a mandatory requirement for financial institutions due to the number of problems related to privacy and data quality that are easily solved by this technology.

The benefits of using synthetic data are very diverse, from solving bias in data to increasing customer knowledge through better segmentations, and thus obtaining better business dynamics and market opportunities.

Apart from the benefits, synthetic data opens a new range of use cases for banks and financial institutions, since they could leverage their data assets to foster innovation while keeping their customers' privacy.

Do you want to know more about the uses of synthetic data in banking and its applications? Do not miss the next article about Uses cases of synthetic data in banking.