The insurance industry is currently undergoing a significant transformation, with agile and swiftly progressing insurtech startups. The sector has a vast amount of data and the necessity to leverage it as a tool for the development of its services: to optimize customer experience, develop new products and features, and identify risks. These are just a few of the most relevant and pressing areas where data lies at the core of solutions.

Insurance industry in context

As pivotal as data is for driving industry development, equally crucial is adhering to current data protection regulations. Nowadays, focusing on compliance is compromising the agility of data, limiting organizations' capacity to utilize them, resulting in a sense of immobility.

Privacy protection is withholding the potential of the data. As a side effect, other areas of the companies suffer from lower productivity, missing opportunities in enhancing customer experience and making accurate forecasting.

This is an undeniable truth: the development of new and smarter products and personalized offers relies on data-driven approaches. To maintain a competitive edge, insurance companies must shift their mindset and begin reimagining their business strategies with advanced algorithms and data at the forefront.

Areas of development and growth for Insurance businesses: Data Agility, what for?

Staying competitive is a challenge in any industry, but it takes on a special nuance in the insurance sector. Customers are now more cautious and discerning. There are some key areas of development where insurers need to grow and refine their products:

Creating new products: what to offer to fulfill new needs? Identifying new segments, targets, and customers: how to get to know and reach them?

Finding the best options to balance risk and profitability: which strategy is more appropriate for keeping that balance and defining the perfect pricing? Improving the customer experience: how to create powerful and easy-to-use applications?

Beyond the technological challenge, the crux of harnessing these realms of development expediently resides in gaining unfettered access to reliable consumer data—insights into their preferences and behaviors. How can efficiency and agility be enhanced in the absence of this essential fuel?

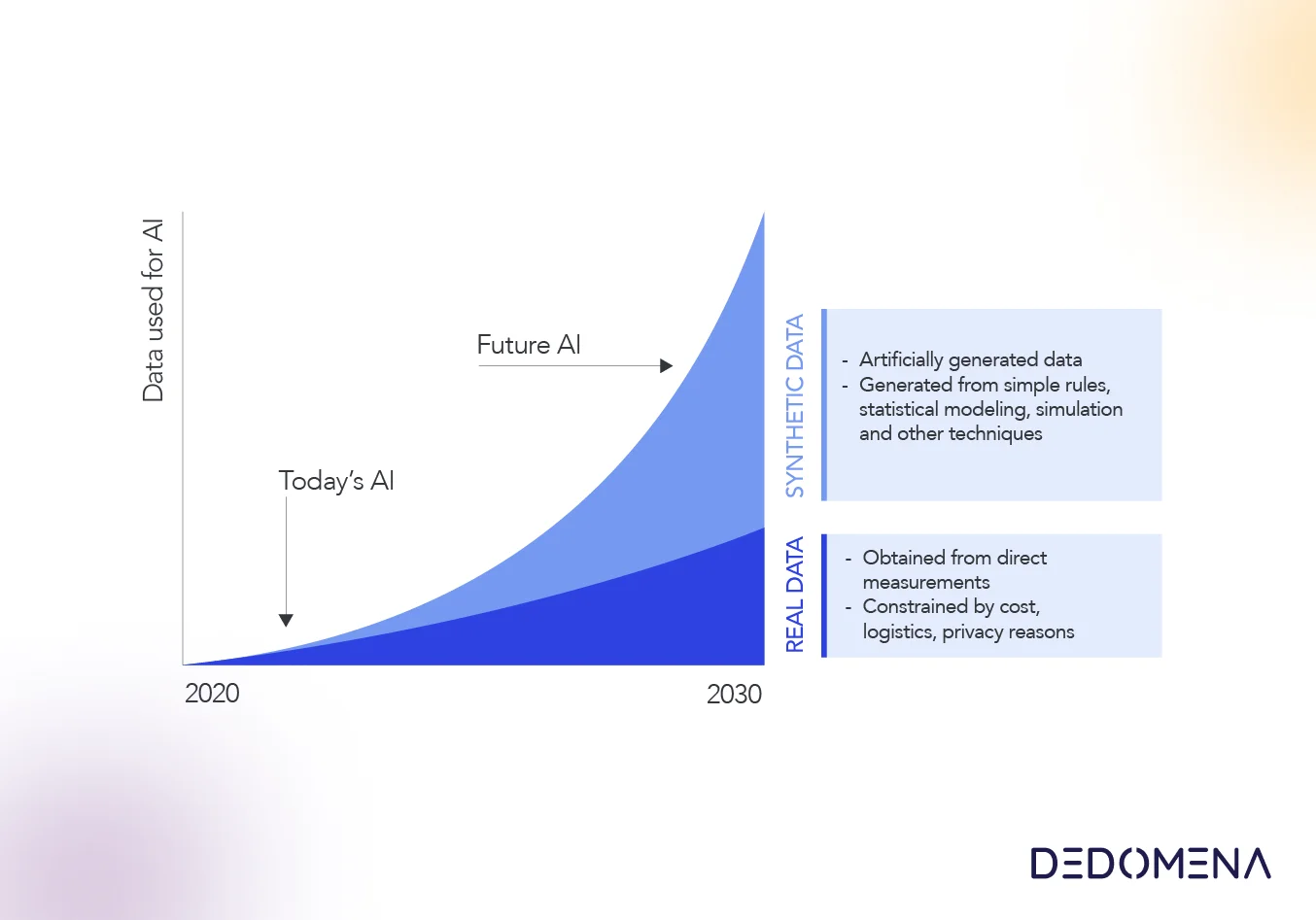

Synthetic Data: the door to Agility and Flexibility

The insurance industry is categorically a data-driven sector moved undoubtedly by data-driven decisions, even in times when computers and AI didn't exist.

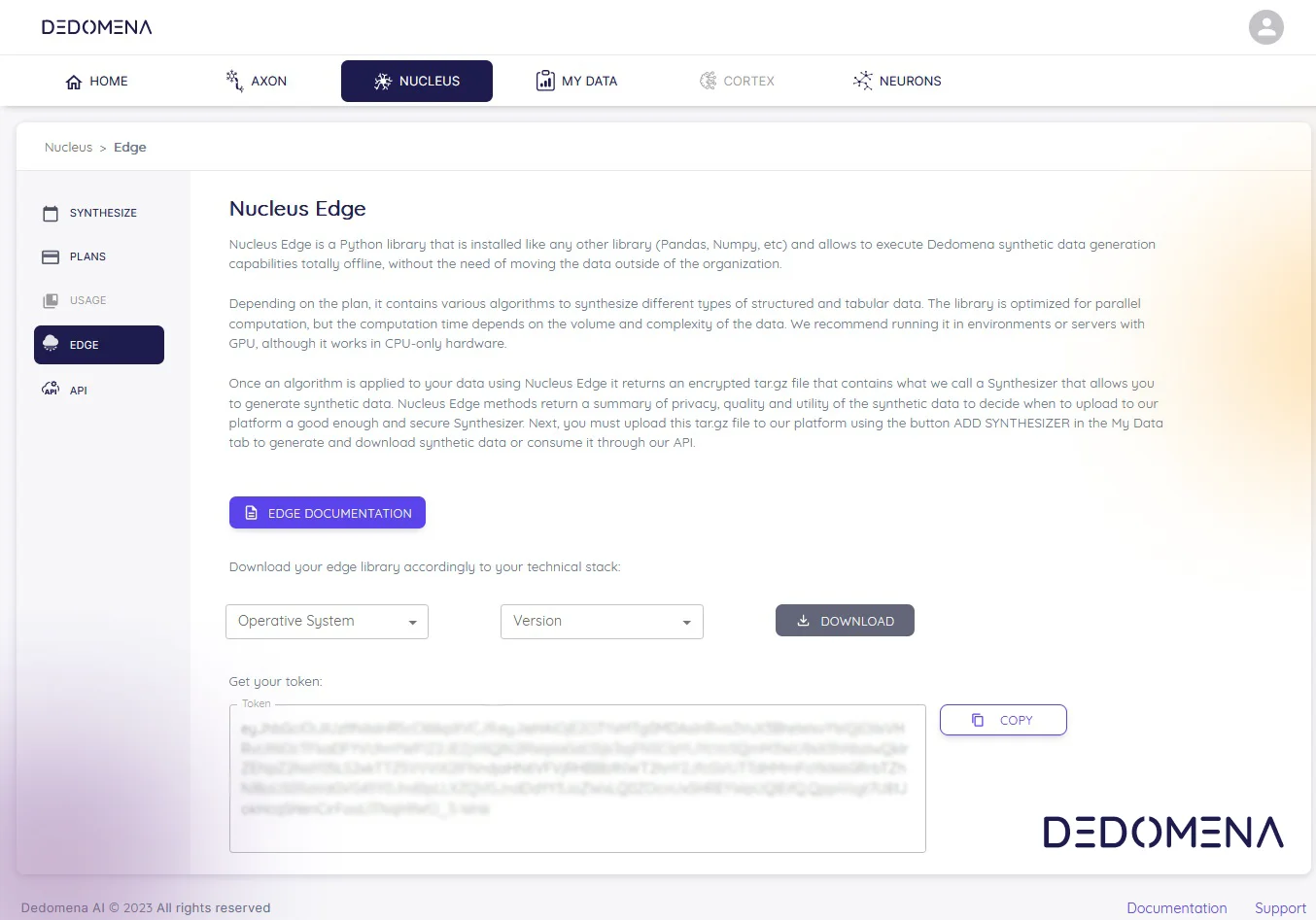

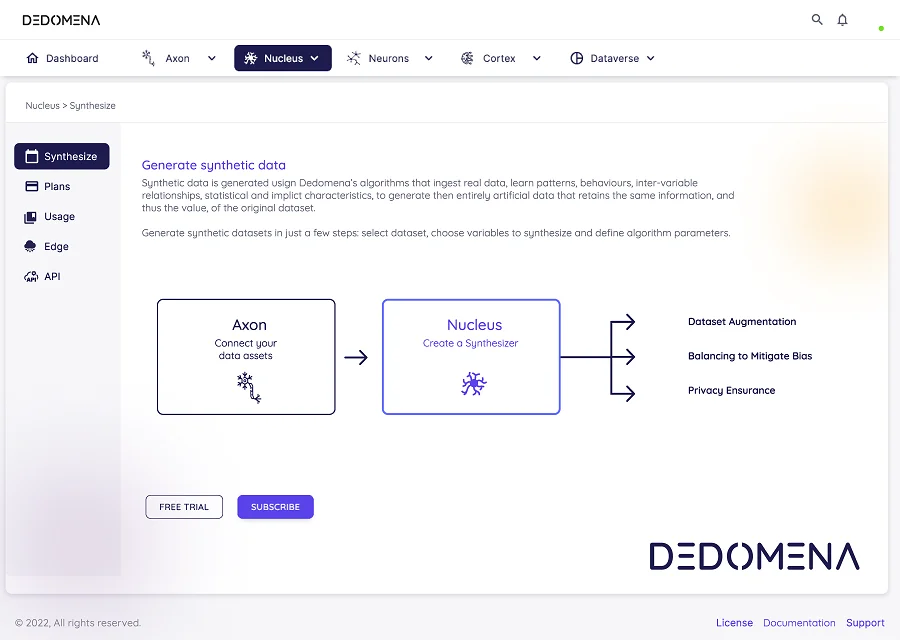

Synthetic data allows companies to work with a synthetic version of a sensitive data resource with an incredible reduction in time-to-data and time-to-insights. Identifying, developing, and testing new products that answer customers’ needs is a process that typically took researchers and data professionals years of work, precisely due to the difficulty in securely accessing the information needed to generate and test the new product.

At this pace of work, there was a risk of working with outdated data and indicators, although new development exercises could take years to materialize. Working with synthetic data represents a reduction from years to months or even days in the process of safely accessing data.

Closely tied to time reduction is the possibility to experience a great cost reduction. With more agile and secure data access, development teams are capable of enhanced efficiency.

Another area of major concern for insurers is related to fraud detection. Detection models used to be biased due to poor access to quality data. Currently, with synthetic data, these models are strengthened and undergo continuous improvements due to the agility in obtaining the data.

Moreover, these not only are agile but also allow for greater breadth and volume, reducing dependence on the limited availability of real information.

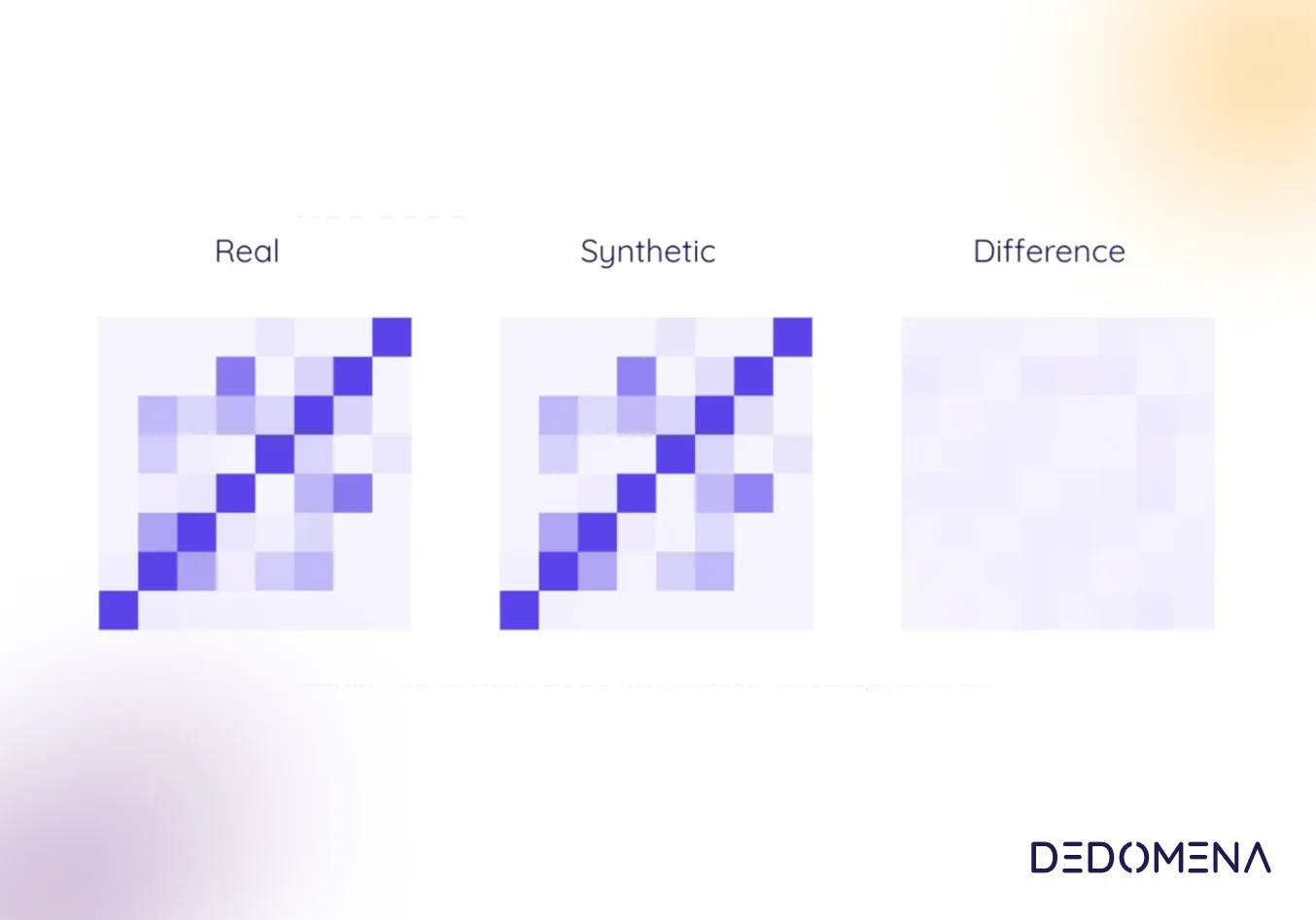

The utilization of data patterns to identify specific characteristics within risk groups has significantly enhanced the precision of insurers' predictions regarding insurance claims. By delving into intricate data patterns and discerning the distinct features that define each risk group, businesses have been able to fine-tune their predictive models. This refinement translates to a more accurate foresight into potential claims, ultimately enabling them to devise tailored strategies and optimize risk management processes with phenomenal flexibility and dexterity.

Lastly, privacy-preserving synthetic data helps in minimizing privacy risks, a critical concern in the insurance sector. With increasing data privacy regulations and customer awareness, maintaining data privacy is non-negotiable. Synthetic data, by its very nature, ensures that no personally identifiable information is exposed, thereby reducing the risks associated with potential data breaches and unauthorized access.

Conclusions

Privacy-preserving synthetic data stands as a viable, secure, and valuable data reservoir for insurance agencies. It offers a spectrum of benefits, notably trimming down the data acquisition time, maintaining data utility, and mitigating privacy risks.

First and foremost, leveraging privacy-preserving synthetic data significantly streamlines the time needed to acquire and process data. The conventional approaches to data collection can often be time-consuming, involving complex procedures and legal protocols. In contrast, generating synthetic data involves a more efficient and prompt process, expediting the availability of data for analysis and decision-making within the insurance domain.