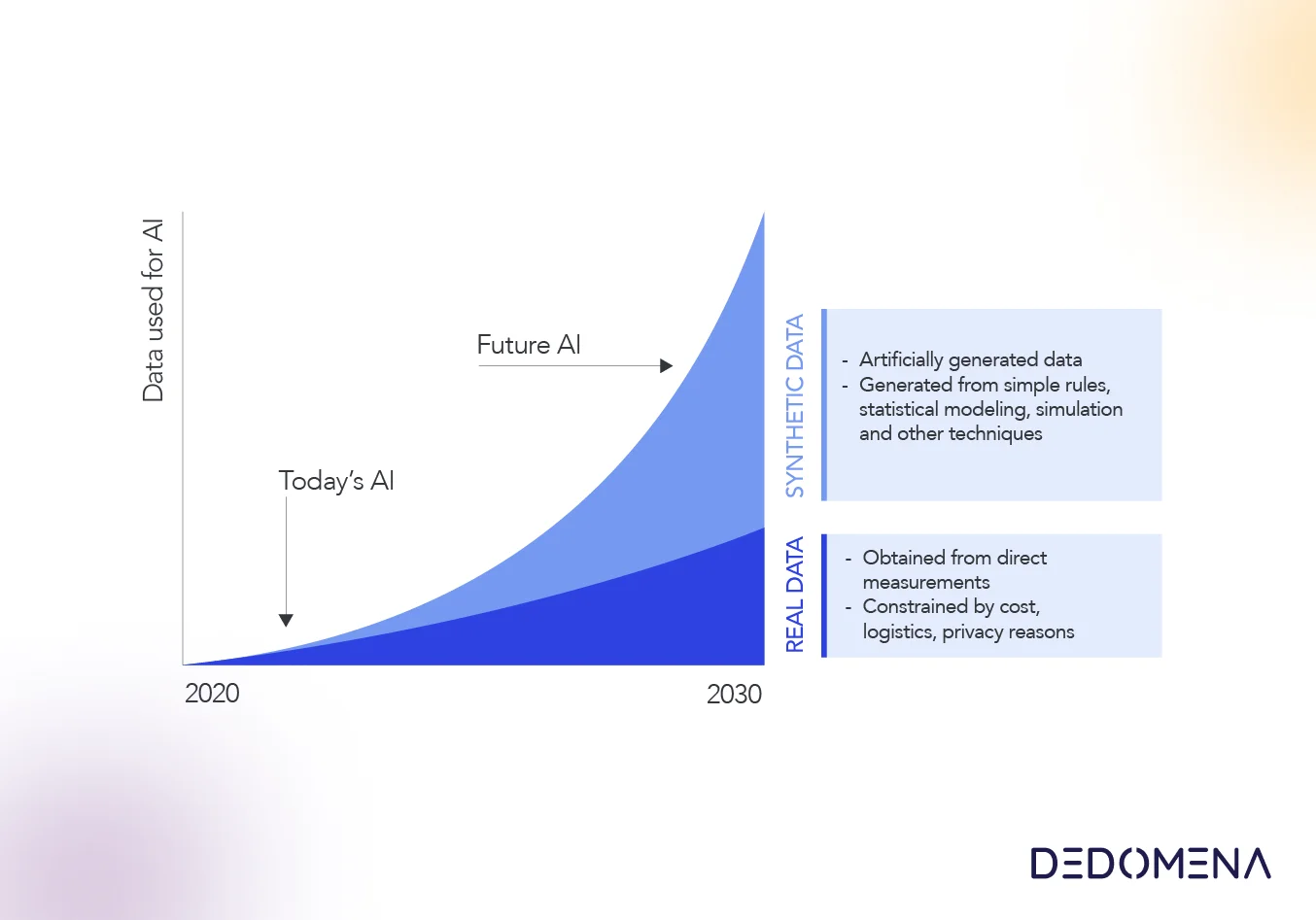

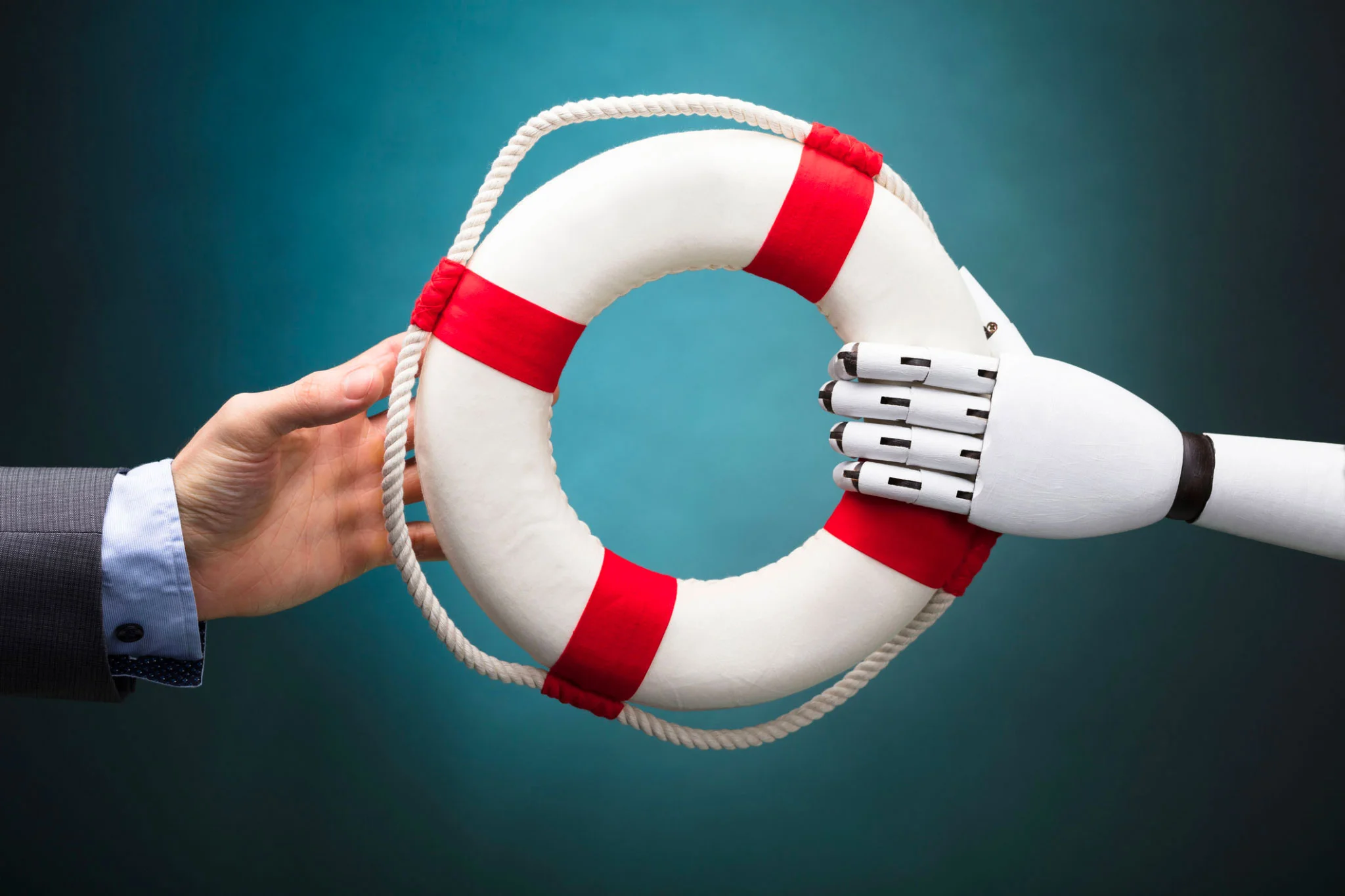

In the rapidly evolving realm of data-driven technologies, the emergence of synthetic data has revolutionized the landscape. It offers businesses a groundbreaking solution to safeguard data privacy while adhering to GDPR regulations. Beyond privacy preservation, synthetic data also addresses the pressing issue of detecting fraudulent activities.

Industries that heavily rely on data often fall victim to fraudulent schemes. From credit card fraud to false insurance claims, companies in these sectors encounter a range of deceitful tactics.

In this context, the need for fraud detection models is paramount. These models aim to swiftly identify fraudulent transactions or activities by analyzing extensive datasets. Uncovering patterns that deviate from standard user behaviors has become a critical capability for businesses.

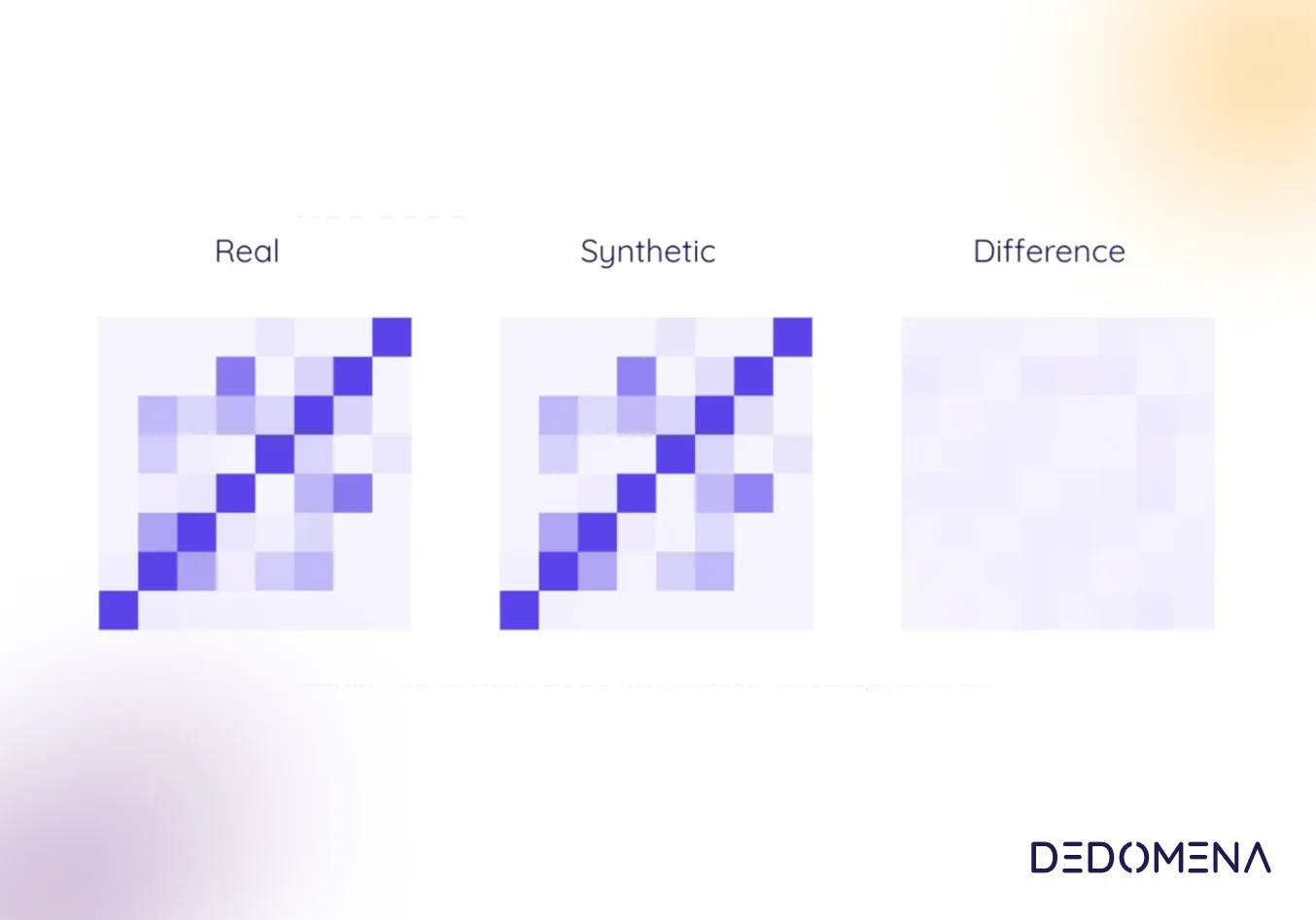

However, fraud detection models face the challenge of distinguishing suspicious from normal behavior. The quality of the datasets used to train these models is pivotal, as their accuracy and effectiveness are directly tied to the data they learn from.

But how can this be achieved effectively? How can we create optimal and intelligent models that excel at detecting fraudulent actions? Here again, data protection regulations limit the use of authentic data.

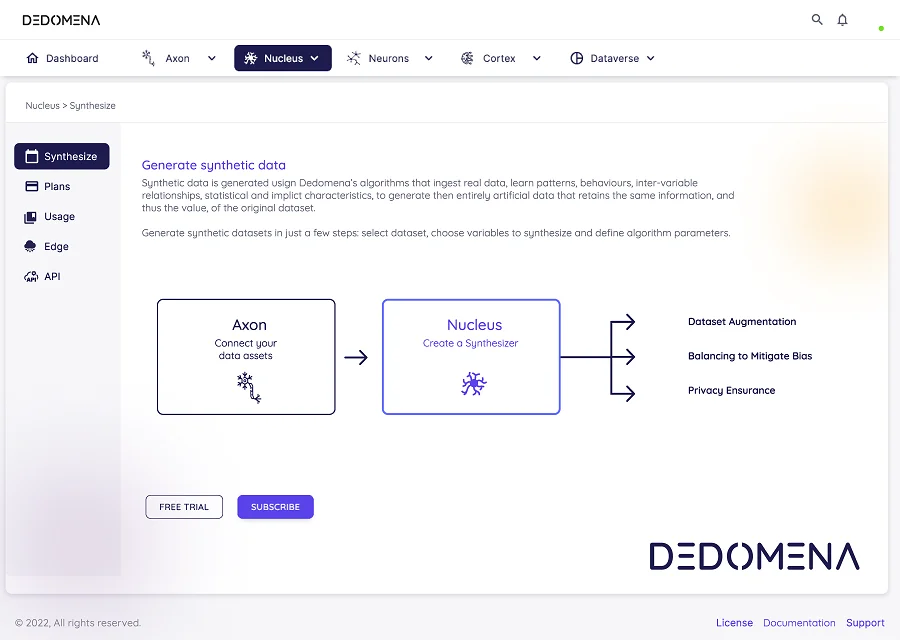

Enter synthetic data—a solution that generates high-quality, diverse datasets closely resembling real data. This innovative approach significantly enhances accuracy, security, and privacy.

Simulating Scenarios

Synthetic data empowers businesses to simulate a variety of fraud scenarios. This controlled environment allows for rigorous testing and refinement of fraud detection algorithms. This simulation capability is invaluable for ensuring the efficacy of fraud prevention strategies without exposing genuine customer data to potential threats.

Boosting Model Accuracy

Synthetic data plays a pivotal role in training and fine-tuning fraud detection models. It expands the range of potential scenarios, equipping the models to handle new and evolving fraud techniques. By supplementing genuine data with synthetic examples and balancing the dataset, these models become more resilient and accurate at identifying fraudulent patterns.

Preserving Data Privacy and Security

Synthetic data offers a critical advantage—preserving individual privacy while enabling comprehensive testing and analysis. In the realm of fraud detection, sensitive personal information is unnecessary, reducing the risk of breaches and ensuring compliance with data protection laws.

Overcoming Data Scarcity

Collecting substantial volumes of genuine data for training purposes can be challenging due to privacy concerns or limited availability. Synthetic data bridges this gap by generating instances statistically akin to real data, effectively expanding the dataset available for training.

Considerations and Balance

While synthetic data presents numerous benefits, it's important to acknowledge that it's not a universal solution. To effectively capture the complexities of real-world scenarios, careful calibration of generation algorithms is necessary. Striking the right balance between data realism and privacy preservation is key to achieving meaningful results.

In the dynamic realm of fraud detection, synthetic data emerges as a potent tool harmonizing accuracy, privacy, and security. Its role in training fraud detection models to identify evolving fraud techniques while respecting data privacy regulations cannot be understated.

As businesses confront sophisticated fraud attempts, harnessing the potential of synthetic data will undoubtedly fortify fraud detection strategies and uphold customer trust.